BIS Presents Vision of "Finternet"

BIS Presents Vision of "Finternet" Based on Unified Registry Technology

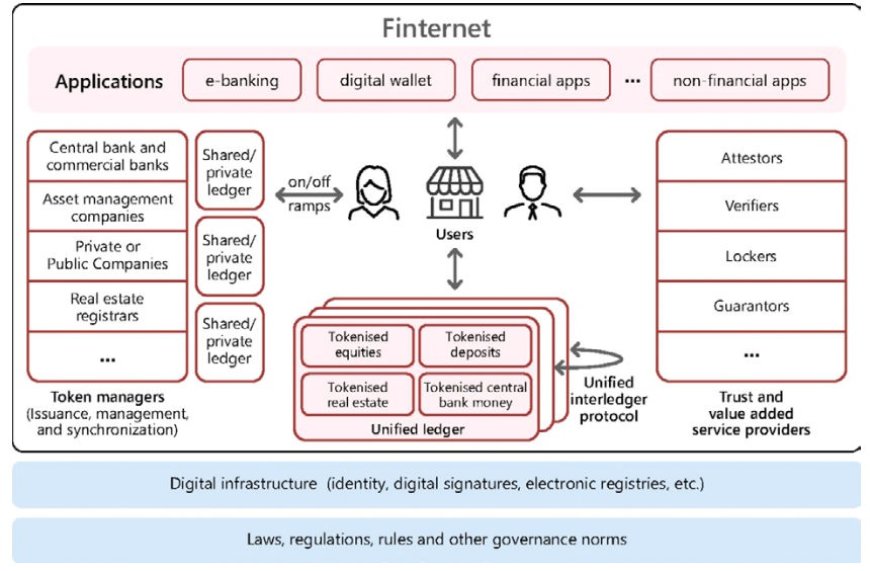

The Bank for International Settlements (BIS) has decided to revolutionize global finance by presenting the latest concept of "Finternet," powered by unified registry technology. In a recent article co-authored by BIS chief Agustin Carstens, the institution extensively discussed its vision of unified registry technology, presenting compelling arguments for its adoption as the foundation of the future financial system.

According to BIS's vision, unified registries have the potential to address several challenges faced by the current financial landscape. By streamlining processes and increasing efficiency, they promise significant improvements in the speed, compliance, and privacy of financial transactions. Unlike traditional systems relying on distributed databases, unified registries consolidate all necessary elements – financial assets, ownership records, usage rules, and more – into one programmable platform.

The flexibility offered by unified registries surpasses the capabilities of existing transactional platforms, providing users with a seamless experience. Even complex transactions, often hidden behind layers of proprietary databases, can be executed with greater transparency and efficiency. Additionally, consolidating transaction components in one place reduces reliance on external communication systems, paving the way for a more secure and reliable financial ecosystem.

It is worth noting that BIS envisions not a single unified registry but rather a network of interconnected registries operating within a broader financial system. Such a decentralized approach promotes interoperability and innovation, enabling smooth integration across multiple financial asset markets.

Asset tokenization, especially of money, plays a crucial role in enabling transfers through smart contracts within unified registries. To ensure compliance with regulatory requirements, the proposal introduces the role of a tokenization manager responsible for overseeing regulatory compliance.

The concept of unified registry technology has gained recognition beyond BIS, with initiatives such as Project Agora, involving seven central banks, exploring its potential for central bank digital currencies and tokenized money transfers. Additionally, global financial institutions such as SWIFT and the International Monetary Fund have expressed interest in similar concepts, signaling broader recognition of the transformative potential of unified registry technology.

In summary, BIS's vision of a "Finternet" powered by unified registry technology represents a significant step forward in transforming the future of finance. By addressing key challenges and unlocking new innovation opportunities, unified registries have the potential to revolutionize global financial systems and pave the way for a more inclusive and efficient financial ecosystem.