Mastercard and US Banks Test Settlement Technology

Mastercard and US Banks Test Equity Settlement Technology for Tokenized Assets

Mastercard, in collaboration with leading banks in the United States, is testing new technology in the field of finance. This innovation aims to facilitate the smooth settlement of tokenized assets, including commercial bank money and various securities such as treasury bonds and high-rated investment-grade debts.

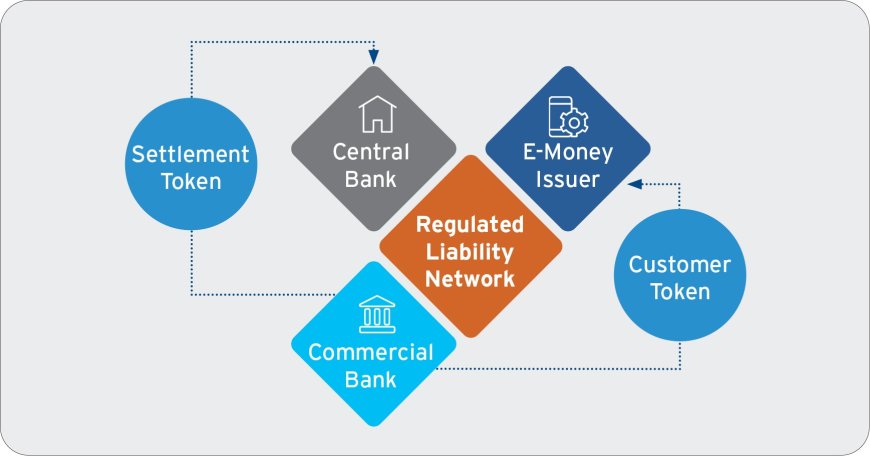

The initiative, named the Regulated Settlement Network, aims to streamline dollar transactions while minimizing the risk of errors and fraud. By employing tokenized assets and utilizing distributed ledger technology, settlement processes can be consolidated onto a unified platform. This experiment follows a 12-week test that focused on domestic and cross-border dollar payments conducted at the end of 2022.

Institutions participating in the tests include Citigroup Inc., JPMorgan Chase & Co., Visa Inc., Swift, and other significant financial entities. Although financial institutions worldwide are exploring the potential of shared registries for tokenized transactions, commercial deployment is not guaranteed based on this test.

In a separate development, major US banks are seeking support from the Securities and Exchange Commission (SEC) to participate in the recently approved market for Bitcoin exchange-traded funds (ETFs). Leading banking associations such as the Bank Policy Institute (BPI) and the American Bankers Association (ABA) have jointly written to SEC Chairman Gary Gensler seeking modifications to regulations to facilitate their participation.

Meanwhile, the closure of Republic First Bank, the second bank failure since 2023, underscores the challenges facing the banking sector. This event clearly highlights existing problems in the industry and underscores the need for regulatory adjustments to address systemic vulnerabilities.